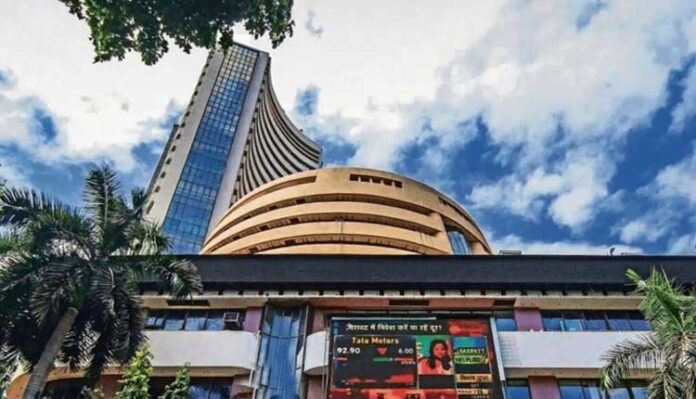

MUMBAI: India’s benchmark stock indices, Sensex and Nifty, plunged nearly 1 per cent on Friday, marking their sixth consecutive day of decline. The sell-off followed US President Donald Trump’s announcement of a 100 per cent import duty on pharmaceutical drugs effective October 1.

The 30-share BSE Sensex tumbled 733.22 points or 0.90 per cent, settling at 80,426.46, its lowest closing in three weeks. During intra-day trading, it hit a low of 80,332.41, down 827.27 points or 1 per cent.

Similarly, the 50-share NSE Nifty dropped 236.15 points or 0.95 per cent, closing at 24,654.70. The index has experienced a decline since September 19, shedding over 3 per cent during this spell, with Sensex losing 2,587.50 points or 3.16 per cent over the last six days.

Pharmaceutical shares faced significant selling pressure, leading the BSE Healthcare index to decline by 2.14 per cent after Trump’s tariff announcement. Notably, Wockhardt shares plummeted by 9.4 per cent.

Trump announced on a social media platform that starting October 1, 2025, a 100% tariff would apply to imported branded and patented pharmaceutical products unless companies establish manufacturing plants in the United States. He specified that companies must start construction to avoid the tariff.

Among the large-scale laggards in the Sensex, notable names included Mahindra & Mahindra, Eternal, Tata Steel, Bajaj Finance, Asian Paints, Sun Pharma, Tech Mahindra, Infosys, Tata Consultancy Services, and HCL Technologies. Conversely, Larsen & Toubro, Tata Motors, ITC, and Reliance Industries witnessed gains.

“Indian equities ended sharply lower on Friday amid a broad-based sell-off after the US announced steep tariffs on imports of pharmaceutical products. This unexpected move rattled investor sentiment, already fragile from the recent hike in H-1B visa fees, which triggered extensive selling in IT stocks this week,” said Ponmudi R, CEO of Enrich Money, a wealth tech firm.

Both IT and healthcare stocks significantly contributed to the market decline as investors hurried to reassess earnings outlooks and export growth prospects amidst rising uncertainties.

Analysis of Asian markets revealed that South Korea’s Kospi, Japan’s Nikkei 225, Shanghai’s SSE Composite, and Hong Kong’s Hang Seng finished considerably lower.

While equity markets in Europe showed positive trends, US markets had ended lower the previous day.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 4,995.42 crore on Thursday, according to data from stock exchanges.

In related market developments, global oil benchmark Brent crude dipped 0.27 per cent to USD 69.23 a barrel, reflecting the overall bearish sentiment in the global markets.

On Thursday, the Sensex closed down 555.95 points or 0.68 per cent at 81,159.68, whilst the Nifty fell 166.05 points or 0.66 per cent to 24,890.85.